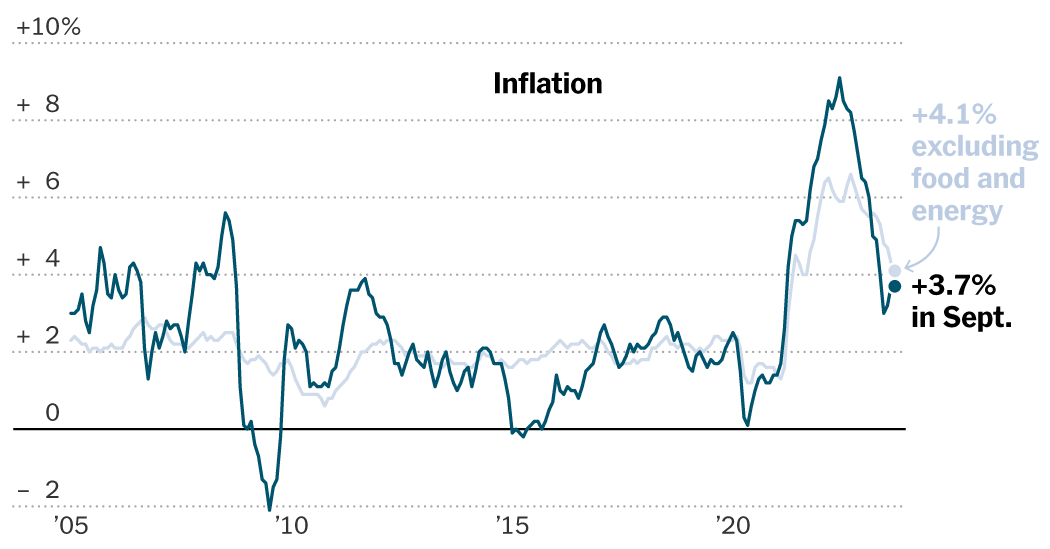

Post-pandemic economic conditions have resulted in surging inflation throughout the United States over the past three years. September’s inflation report was released on Oct. 12 and showed no change from August, with the consumer price index still up 3.7% from the year before. While this is drastically lower than June 2022’s peak of 9.1% it still remains above the Federal Reserve’s target of 2%.

The consumer price index, or CPI, is a preset basket of common goods purchased frequently by American consumers. It is the most commonly used measure of inflation in the United States, garnering frequent use by lawmakers, financial institutions and consumers themselves. While the specific items included in the CPI can vary as consumer behavior fluctuates, the top categories of goods include food and beverage, housing costs, healthcare, transportation and educational expenses.

For students and other young adults, soaring inflation has had noticeable impacts on daily life and decisions surrounding essential goods, causing many to remain up-to-date with inflation reports. “I think the last percentage point needed to get inflation down to the 2% target is going to be very difficult, especially with sustained increased spending from consumers,” said junior Nick Schaffer, a Finance student at the University, “It’s affected me most at the grocery store where it now costs almost twice what it used to so I’m more conscious about what I buy.”

Groceries in New York City are uniquely expensive compared to the rest of the United States, with the average monthly grocery expenses in the city being roughly 39.7% higher than the national average, not accounting for inflation. While New York City does have a considerably higher cost of living than the rest of the country, groceries are still exceptionally expensive. The sharp rise in inflation over the last few years has inevitably exacerbated this, requiring New Yorkers including students to spend dramatic portions of their income on basic groceries.

Housing costs are another key element of the CPI which impact students and young adults. As inflation soars, so does rent. For those in the market to purchase a home, inflation can cause even more complex hurdles. Naturally, the cost of purchasing property has risen, but as the Federal Reserve raises interest rates, so does the cost of borrowing money to finance a home. Current rates on 30-year mortgages are hovering around 8.6% in New York State, compared to 3.9% in 2019. However, as inflation cools, both mortgage rates and home prices will fall. As stated by University Finance junior George Davis, “Specifically within the realm of real estate, following such steady increases, I feel that there is pent up demand in the market and once the inflation rates slow down there will be more of a boom in this market. The real estate market has not performed this poorly since 2008. As a student looking for a home in the near-mid future, this is an optimistic trend over the long-term.”

Despite the lack of progress in taming inflation per September’s report, economists and consumers alike remain confident that the Federal Reserve’s target of 2% will be met in the near future. Speculation remains around whether or not interest rates will see another hike, which would ideally bring down spending just enough to cut down the final 1.7%.