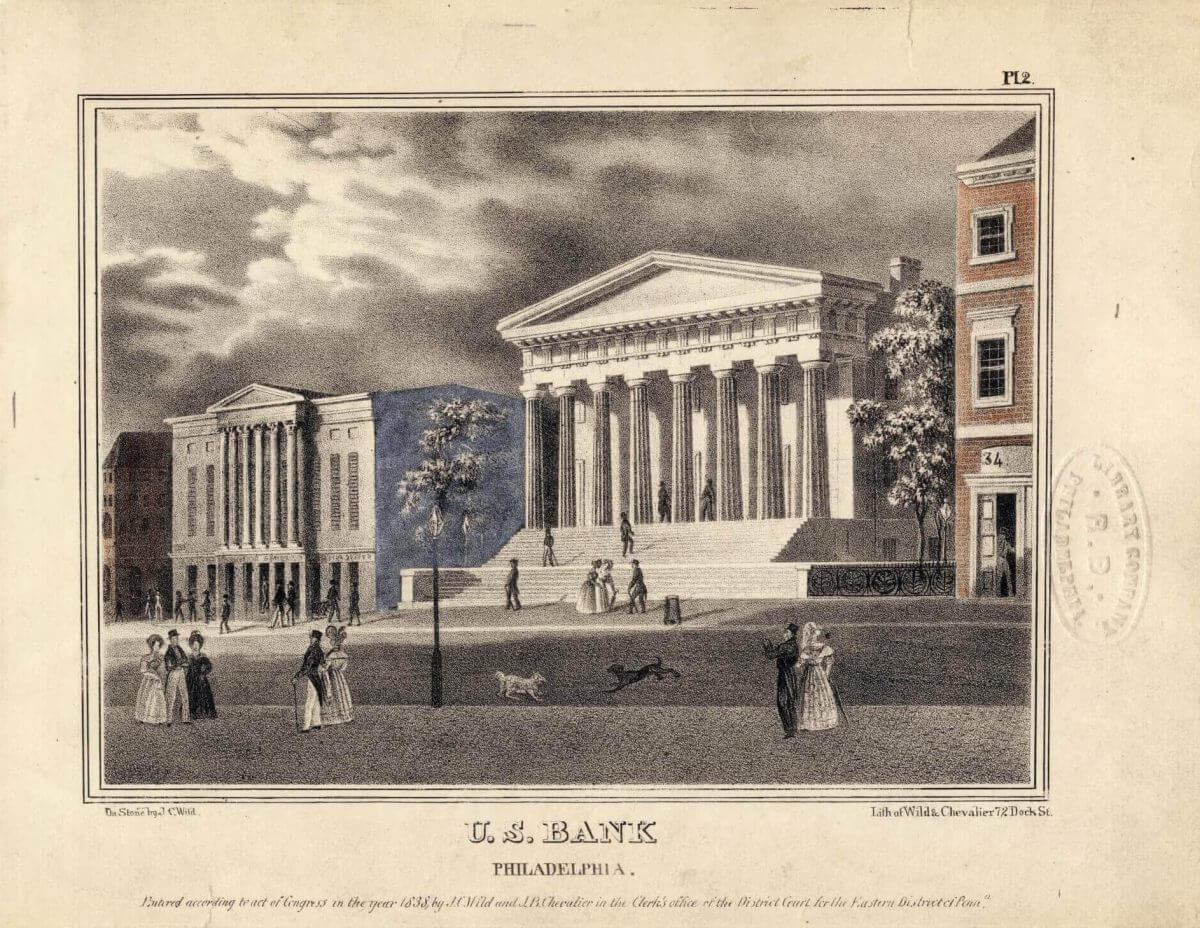

If you ever feel like your taxes are unfair, just remember that James McCulloch, the guy who refused to pay Maryland’s attempt at financial extortion, ended up making Supreme Court history. In 1816, Congress flexed its federal muscles and created the Second Bank of the United States, planting branches across the country, including one in Baltimore, Maryland. The Maryland legislature, not exactly thrilled about a federal bank operating on its turf, passed a law in 1818 placing an annual $15,000 tax on any bank not chartered by the state. This, of course, was a strategic way of saying, “We don’t want your federal money business here.”

McCulloch, a Baltimore branch cashier, essentially said, “Yeah, no thanks,” and refused to pay the tax. Maryland government officials, feeling disrespected, sued McCulloch in the Baltimore County Court. After losing in Maryland’s courts, McCulloch took his case to the Supreme Court, setting the stage for a landmark showdown over the federal government’s powers.

The Supreme Court considered two key questions: First, does Congress have the constitutional authority to create a national bank? Second, if Congress does have that power, can a state tax a federally created institution? Maryland argued that Article I, Section 8 of the Constitution, does not explicitly say that Congress can create a national bank. Technically, they weren’t wrong. However, McCulloch’s legal team countered this with the Necessary and Proper Clause, which some consider the “standout clause” of implied powers. This provision states that Congress can enact laws that aren’t specifically stated in the Constitution as long as they support the exercise of its listed authorities. These can include declaring war, controlling interstate commerce and collecting taxes.

The idea of implied powers (those not expressly mentioned but essential to the efficient operation of the government) was first presented by this argument. They contended that a national bank was a natural progression of such authorities. The Court’s unanimous 6-0 ruling was written by Chief Justice John Marshall, renowned for strengthening the federal government whenever he had the opportunity. He decided that since the Necessary and Proper Clause grants implicit powers, Congress could establish a national bank. Marshall firmly denied that Maryland may tax the federal bank in response to the second question. Why? Because, as Marshall famously put it, “The power to tax involves the power to destroy.” If states could tax federal institutions, they could theoretically tax them out of existence. That wouldn’t just be unfair; it would undermine federal authority entirely, which we all know he was against. Marshall firmly established the supremacy of national laws over state laws by reaffirming that the federal government has implicit powers required to fulfill its listed responsibilities. Since federal laws are supreme over state laws, Maryland’s tax was deemed unconstitutional.

This case was about more than banking disputes and charter issues. It fundamentally shaped the balance of power between the states and the central government. While later cases like United States v. Lopez would sometimes tip the scale in favor of state authority, McCulloch remains a titan in constitutional law. Since this decision, courts have frequently returned to McCulloch when determining the scope of federal power over the states. Though it may seem like an old, esoteric case about bank charters and taxes, McCulloch v. Maryland was a battle of constitutional proportions. Ultimately, it reinforced the idea that the Constitution is a living document, granting the federal government the flexibility to adapt and govern effectively. Funnily enough, it all goes back to a tax-dodging bank cashier and a Supreme Court Chief Justice who had no patience for state interference.