The political stepping stones to federally legalizing marijuana

May 11, 2022

What many pot-enthusiasts believed to be a cruel April Fool’s joke on the devil’s lettuce, ended up being a dream-turned-reality when Democratic, House Judiciary Chairman Jerrold Nadler’s Marijuana Opportunity Reinvestment and Expungement (MORE) Act passed in the House of Representatives with a 220 to 204 majority vote on April 1.

Since the genesis of the Controlled Substance Act (CSA) was enacted in 1970, marijuana has been categorized under Schedule I, a list of federally regulated substances considered to have the most potential for danger, abuse and addiction, out of the five schedule categories in the CSA—until now.

If approved by the Senate and President Biden, the MORE Act will federally legalize the manufacturing, distribution, dispensation and possession of marijuana for people 21 or older, as well as de-schedule the drug from Schedule I and will exonerate and expunge individuals incarcerated with nonviolent marijuana-related charges across the nation.

The House initially passed the bill in December 2020, but it did not succeed in the Senate. To that effect, Nadler reintroduced the legislation on May 28, 2021, making headway through the House in April and marks the second time the bill will reach the Senate floor with high tides of strong political pushback in its wake.

In a world where the MORE Act is decreed, marijuana products will be subject to a minimum five percent federal excise tax “for the first two years after enactment,” according to The National Law Review. Once reaching the fifth year of administration, the federal excise tax will be raised to eight percent.

The tax revenue will be going to an Opportunity Trust Fund (OTF), created and funded by the U.S. Treasury, the allocation of which 50 percent will go to the Attorney General for the Community Reinvestment Grant Program (CRGP); 10 percent to the Attorney General for substance use rehabilitative services; 20 percent to the Small Business Administration (SBA) for the Cannabis Opportunity Program (COP); and 20 percent to the SBA of the Equitable Licensing Grant Program (ELGP). In addition, cannabis growers and importers will be required to obtain a federal permit and pay up to $1,000 in federal taxes per facility they manage.

Furthermore, the legislation will create the Office of Cannabis Justice which will be responsible for overseeing “the social equity provisions in the law,” according to the Marijuana Policy Project. The bill will also ensure the federal government does not unlawfully discriminate against people based on cannabis use, “including earned benefits or immigrants at risk of deportation.”

Lastly, the bill is anticipated to open several doors to expand cannabis research and implement improved banking and tax laws with the goal to fuel the economy as an additional financial resource.

It’s not that the Senate is opposed to federally legalizing cannabis. On the contrary, the Senate has their “own comprehensive bill on marijuana reform called the Cannabis Administrative and Opportunity (CAO)” Act, states The National Law Review, which was introduced by Democratic Senators Cory Booker of New Jersey, Ronald Wyden of Oregon and Senate Majority Leader Charles Schumer in July 2021.

According to Schumer, he plans to formally introduce the CAO Act later this April after the final version of the bill is complete. A detailed summary of the Act was released on Sept. 1, 2021, to receive amendments from constituents in terms of what to include or exclude. The CAO Act is relatively similar to the House’s proposed legislation; federally legalizing cannabis, removing the substance from Schedule I and acquitting those with nonviolent marijuana-related convictions.

The CAO will also create an OTF however, compared to the MORE Act, it will institute a 25 percent federal excise tax on marijuana products. The bill is specifically catered to benefit marginalized groups and “communities impacted by the failed War on Drugs, as well as helping to level the playing field for entrepreneurs of color who continue to face barriers of access to the industry,” states the CAO Discussion Draft. Notably, the Act will contribute to continuous efforts to end discrimination “in federal public benefits for medical marijuana patients” and adult consumers.

37 states, the District of Columbia, Puerto Rico, Guam and the U.S. Virgin Islands have already legalized medical marijuana. 18 states, the District of Columbia, the Commonwealth of the Northern Mariana Islands and Guam, legalized the substance for medical and recreational adult use. However, the process to federally legalize marijuana has tremendous strides ahead, even if the Senate agrees, in all three branches of government; the Legislative Branch seeking Congressional approval, the Executive Branch for presidential sign-off and street-level bureaucratic enforcement and implementation and the Judicial Branch to delineate the regulations of the law.

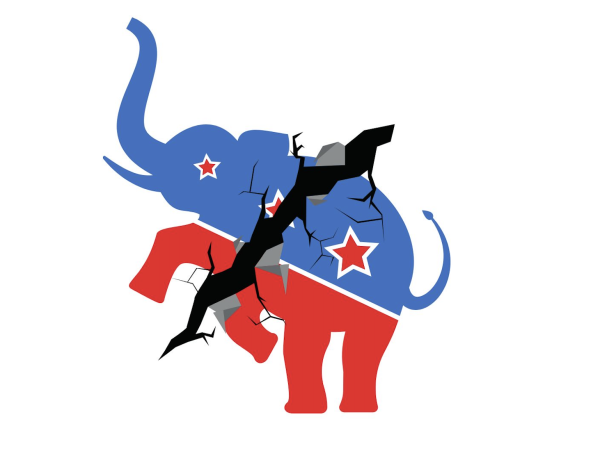

Overall, it is not a matter of if marijuana will be federally legalized, but it is a matter of when Congress will tenaciously hurdle over gridlock to appease a conglomerated proposed bill, with elements taken from the MORE and CAO Act to satisfy both the congressional constituents.